When you think of technological advancements you probably imagine something physical like the steam engine, the computer, the airplane. Social processes and ideas can be just as powerful in moving us all forward. These banal processes often seem obvious in hindsight and are overlooked. Double entry bookkeeping is one of my favorite examples of something that is ubiquitous and seems like we always have. It is a data standardization and quality tool that makes it possible to track financial transactions and entities. These testable assertions laid the groundwork for more complex financial products and in turn built the capital base that pulled Europe out of the Dark Ages and into modernity.

What is it?

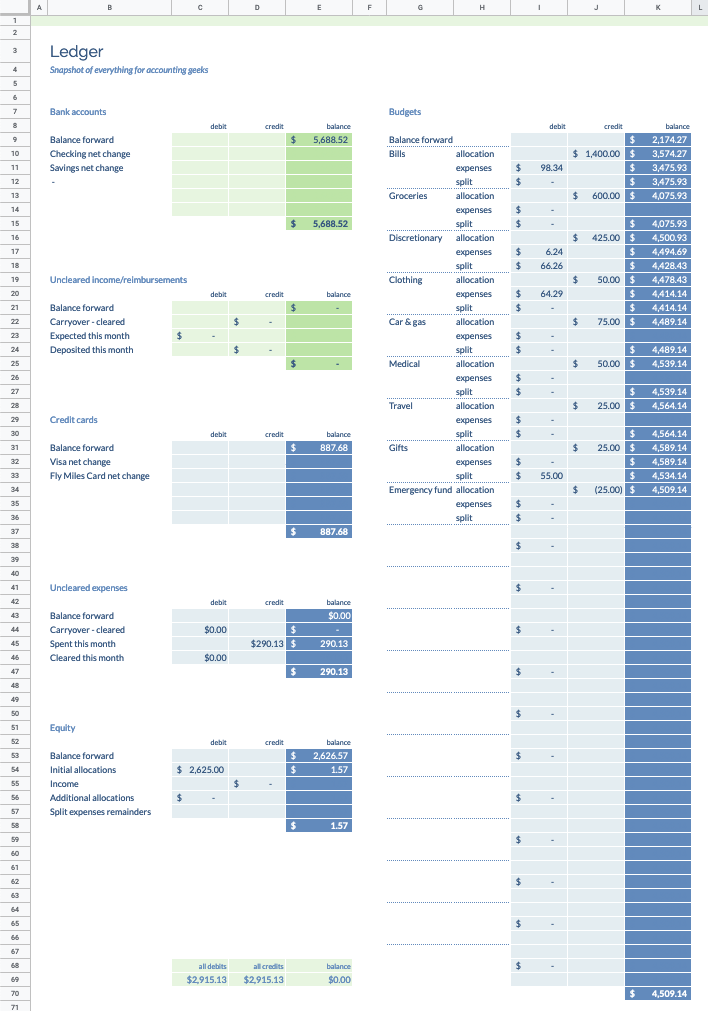

Double-entry bookkeeping is an accounting system where every financial transaction is recorded in at least two different accounts. Every entry has two sides - a debit and a credit - and the total debits must always equal the total credits, maintaining a perfect balance.

For example, when a business buys $5,000 of inventory with cash, this single transaction is recorded in two places: the inventory account is debited (increased) by $5,000, and the cash account is credited (decreased) by $5,000. When money is borrowed, cash is debited (increased) while the loan liability is credited (increased). This dual recording creates built-in verification - if the books don't balance, there must be an error somewhere. The system tracks five main categories: assets, liabilities, equity, revenues, and expenses, providing a complete picture of a business's financial position and making it possible to generate accurate financial statements like balance sheets and income statements.

The Commercial Revolution

Merchants had to get around the Catholic Church’s ban on usury. Capital formation was stunted by limited credit. What kind of financial minds would they be if they couldn’t figure out a way of out of this. Trade between different markets and exchanging currency was their way to make a spread.

By the 1300s Europe was well on its way from pulling out of the dark ages. In the East, the Mongols had created the largest land Empire the world has ever known. Through the use of the sword, they broke down trade barriers from China to the Mediterranean World. Macro Polo journeyed to China during this period.

The Italian city-states were at their peak during this period. They were in the right position geographically and had strong merchant traditions to take advantage of this opportunity. They monopolized trade between the Catholics, the Byzantines, and the Muslim world in the Mediterranean.

Traveling overland to from Italy to China took 3 years back then. Going the whole way doesn’t make sense for one person. Shrewd merchants understood it was more profitable to stay in one place and have others move the goods for you.

England had the highest quality wool. But the journey to finished goods involved a few middlemen. First to Flanders, then Champagne for dyeing, then to Italy for processing into clothes and then shipping to to the Mediterranean and the Black Sea. Some Italian merchants decided to cut out the middlemen and place their agents at key locations. This ended up being immensely lucrative.

The first step in the commercial revolution was the formation of commercial banks to make it all happen. These concerns were immensely successful, provided the following services and translated to political power (medici etc). With the capital they generated from trade they expanded into other financial products .

Commercial banking services offered:

Bought/sold inventory

Deposit banking

Provided loans and investment

Long distance credit and cash transfer - the Templar’s pioneered this a century earlier with chits that could be exchanged in Templar houses in different areas

Licensed tax collectors and customs duties

Company structures to diversify risk and pool capital

Insurance contracts for shipping

Fuel for the Fire

Merchants needed more sophisticated ways to track increasingly complex transactions involving multiple currencies, distant partners, and extended credit arrangements. The earliest known record of the system appears in the archives of Florentine merchants in the late 13th century, though it likely existed in simpler forms before then

The system was first formally documented by the Franciscan friar Luca Pacioli in his 1494 work "Summa de arithmetica, geometria, proportioni et proportionalita," though he described it as an already established Venetian practice. Pacioli didn't invent the system but rather documented the methods used by successful merchants of his time. His description included vital features still used today: the use of journals and ledgers, the rules for debit and credit entries, and the preparation of trial balances and year-end procedures. The system proved so effective at preventing errors and tracking complex business relationships that it spread throughout Europe during the Renaissance, laying the foundation for modern accounting.

Impact and Legacy

The Commercial Revolution transformed medieval Europe both politically and culturally. Merchants gained unprecedented social status and political power, with the wealthiest merchant families like the Medici wielding state-like authority.

Their influence is still visible in the architecture of major trading cities - from Venice's palazzo to the merchant walls of Ypres. I cant tell if they look similar by design or if I just picked these two pictures.

The merchant class also reshaped medieval culture. They could only invest so much of their proceeds into new ventures and political machinations, so the surplus went to pleasure. Their rising prominence appears in contemporary literature like Chaucer's Canterbury Tales (Chaucer himself was a merchant's son and he picked up ideas for his tales from hearing sea stories). Trade routes carried more than goods - they became networks for exchanging ideas and stories across Europe, driving cultural exchange and innovation throughout the continent.

Data Quality in the Present Day

We're drowning in data but can't fully trust it. Big companies (generally) have solid data testing and quality control, but most teams (especially startups) skip these steps to move faster. It's like running a factory without quality inspection - you can ship products quicker, but problems pile up. Everyone's been in meetings where someone says "these numbers look off," and suddenly all your data-driven decisions feel shaky.

Just like medieval merchants needed standard bookkeeping to unlock trade's potential, we need standardized ways to ensure data quality. Right now, every company handles data quality differently (if at all). But imagine if we had common frameworks and metrics for data quality - like how double-entry bookkeeping gave merchants a shared language for trade. This could unlock the next wave of innovation. We might be holding ourselves back from major technological and social advances simply because we can't fully trust and leverage our data. The next big leap forward isn't just about collecting more data - it's about making sure we can trust what we have.